VENTURE FUND?

When to invest?

Impact Investing is growing at an extremely lively pace in recent years in Europe.

It is shown by the stats collected in the last edition of the Eurosif Study. In the 2018-2020 biennium, the assets managed with impact finance have increased from 60 to 132 billion euros marking a jump of +120%.Even in Europe, the masses to which this approach applies are increasing.

Where to invest?

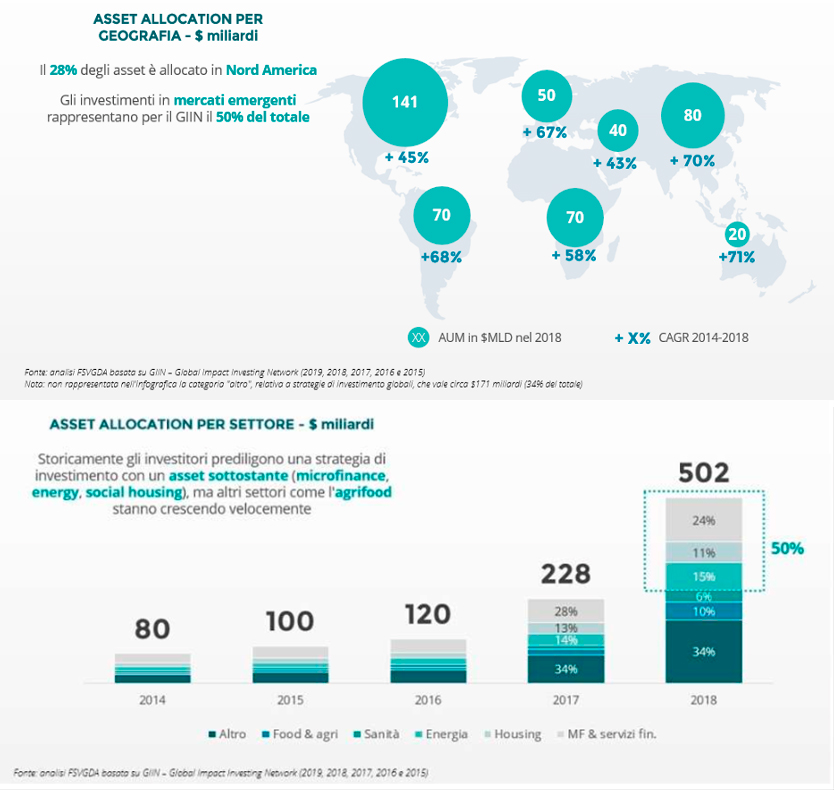

Investors continue to favour microfinance, financial services, social housing and energy, which together make up about 50% of the assets managed.

However, the allocation to other sectors is growing, such asagrifood, from 7% in 2017 to 19% in 2020.

Overview

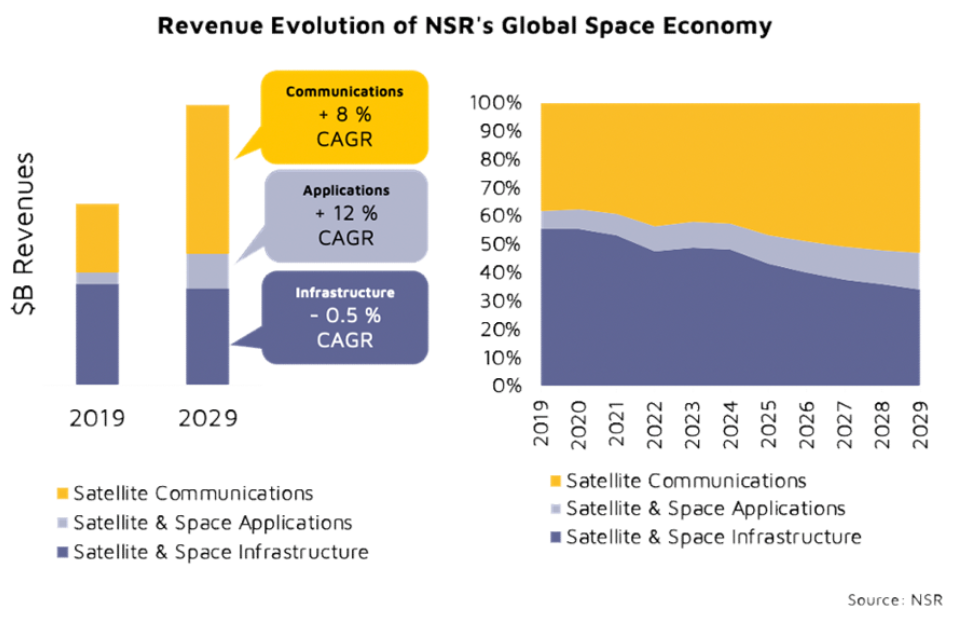

Morgan Stanley estimates that the global space industry could generate revenue of over $ 1 trillion or more in 2040, compared to the current $350 billion. However, the most significant short – and medium-term opportunities may arise from satellite broadband Internet access.

Outlook

The cumulative revenues from Space Tech, of which 45% are from space infrastructure and satellites, 10% from Space Tech applications, while the remaining 45% in satellite communications.